Many young entrepreneurs face the daunting challenge of securing funding for their promising business ideas, particularly when they lack an established credit history. Traditional business loans often require a minimum of two years of operational history and a strong credit score, making them nearly impossible to obtain for startups. In such cases, a personal loan for business can be a viable alternative, offering a pathway to capitalize on innovative ideas. While this strategy can be effective, it’s essential to weigh the potential benefits against risks such as higher interest rates and personal liability.

Toc

- 1. Introduction to Personal Loans for Business

- 2. When Should You Consider a Personal Loan for Your Business?

- 3. Understanding the Pros and Cons of Personal Loans for Business

- 4. How to Qualify for a Personal Loan for Business

- 5. Finding the Best Personal Loan for Your Business

- 6. Alternatives to Personal Loans for Business

- 7. Tips for Using a Personal Loan Wisely for Your Business

- 8. Frequently Asked Questions

- 9. Conclusion

This article explores the world of personal loans for business, examining their potential as a valuable funding option for startups, especially those with limited business credit history. We will discuss the advantages and disadvantages of utilizing a personal loan for business purposes, outline how to qualify, and provide insights on finding the best loan terms. Additionally, we will explore alternative financing options that entrepreneurs should consider.

Introduction to Personal Loans for Business

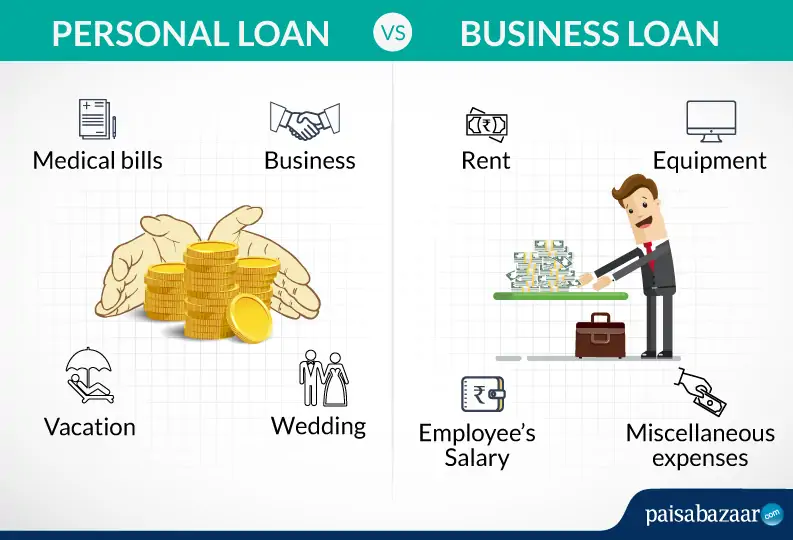

A personal loan for business is a type of financing that an entrepreneur utilizes to fund their startup or small business. This loan is typically obtained from a financial institution or online lender, and the borrower’s personal credit score and income determine eligibility. The loan amount can range from a few thousand dollars to hundreds of thousands, depending on the lender and the borrower’s financial situation.

What are Personal Loans for Business?

A personal loan for business is a type of financing that individuals can obtain based on their personal creditworthiness rather than the financial standing of their business. This distinguishes it from traditional company loans, which typically require an established business credit history and robust financial records.

Key Features of Personal Loans for Business

- Credit-Based Financing: Personal loans rely heavily on your personal credit score, income, and debt-to-income ratio. This makes them accessible for new entrepreneurs who lack business credit.

- Flexibility in Usage: Funds from a personal loan can be allocated for various business expenses, such as purchasing inventory, equipment, or covering operational costs.

- Faster Access to Capital: The streamlined application process for personal loans allows entrepreneurs to access funds rapidly, often within days, rather than weeks or months. This timely access can be crucial for startups.

- Collateral-Free: Personal loans are typically unsecured, meaning they do not require collateral such as property or equipment. This reduces the risk for borrowers but may lead to higher interest rates.

When Should You Consider a Personal Loan for Your Business?

There are specific scenarios where opting for a personal loan for business might be the most appropriate choice:

Limited Business Credit History

For startups with minimal or no established credit history, securing a traditional business loan can be daunting. A personal loan offers a viable alternative, as it primarily considers the individual’s creditworthiness. For example, imagine a tech startup developing a revolutionary mobile app. While the idea is promising, they lack the financial track record to qualify for a business loan. A personal loan, based on the founder’s personal creditworthiness, can bridge the funding gap.

Need for Quick Funding

In the fast-paced entrepreneurial landscape, timing can be everything. Personal loans often have expedited approval and disbursement processes, allowing you to access the capital needed to seize opportunities or address urgent financial requirements quickly. For instance, a fashion designer may need to secure inventory for a pop-up shop at a major fashion event. A personal loan can provide the necessary funds within a few days, allowing them to capitalize on the opportunity.

Smaller Funding Needs

If your startup requires only a modest amount of capital to get off the ground or manage short-term expenses, a personal loan may be better suited than a larger business loan, which often comes with higher borrowing limits.

Understanding the Pros and Cons of Personal Loans for Business

As with any financing option, personal loans for business come with their own set of advantages and disadvantages. Understanding these can help you determine if this funding method aligns with your startup’s needs.

Pros of Personal Loans for Business

- Ease of Qualification: Compared to traditional business loans, personal loans generally have less stringent qualification requirements, focusing primarily on your personal credit profile. However, it’s important to note that entrepreneurs with poor credit history may still find it challenging to secure a personal loan, even if their business idea is promising.

- Faster Funding: The application process is usually quicker, allowing you to access funds more rapidly.

- Flexibility: There are typically fewer restrictions on how the funds can be used, giving you the freedom to allocate the money where it’s most needed. However, some lenders may impose restrictions on how personal loan funds can be used, particularly if the loan is explicitly designated for business purposes.

Cons of Personal Loans for Business

- Higher Interest Rates: Personal loans typically have higher interest rates, particularly for borrowers with lower credit scores, which can significantly increase the overall cost of borrowing.

- Personal Liability: If your business fails to repay the loan, you will be personally responsible for the debt, putting your personal assets at risk.

- Limited Loan Amounts: Personal loans usually have lower maximum borrowing limits compared to business loans, which may not suffice for larger funding needs.

- No Business Credit Building: Using a personal loan does not contribute to building your business’s credit history, potentially limiting future financing options.

How to Qualify for a Personal Loan for Business

If you’re considering a personal loan for business purposes, here are some practical steps to enhance your chances of approval:

Improve Your Personal Credit Score

Lenders will evaluate your personal creditworthiness when assessing your application. Focus on improving your credit score by paying bills on time, reducing existing debt, and correcting any errors on your credit report.

Increase Your Income

Your income plays a significant role in the loan qualification process, as it demonstrates your ability to make monthly payments. Explore opportunities to boost your personal income, such as taking on a side job or negotiating a raise at your current employment.

Gather Required Documents

Prepare the necessary documentation for your personal loan application. This may include proof of income, identification, bank statements, and any other relevant financial documents. Having these materials ready can streamline the application process.

Finding the Best Personal Loan for Your Business

When searching for the right personal loan for business, comparing offers from various lenders is essential. Here are some tips to help you find the most suitable option:

Compare Loan Terms

Examine interest rates, repayment periods, and any associated fees to determine the total cost of the loan. Look for a combination of terms that aligns with your business’s financial capabilities and growth plans.

Consider Online Lenders

Online lenders often provide more flexible requirements and faster processing times compared to traditional banks. Exploring options from reputable online lending platforms can increase your chances of securing a personal loan for business.

Read Reviews and Research Lenders

Before committing to a lender, take time to read reviews, check their reputation, and compare their offerings. This ensures that you select a trustworthy partner for your business’s financing needs.

Alternatives to Personal Loans for Business

While personal loans can be a viable funding option, they are not the only choice available. Here are some alternative financing options for startups:

Small Business Loans

Small business loans, including SBA loans, term loans, and business lines of credit, are specifically designed to meet the diverse financing needs of entrepreneurs at various stages of their business journey. These loans often come with lower interest rates and longer repayment terms than personal loans, making them an attractive option for small business owners. SBA loans, in particular, are backed by the government, which reduces the risk for lenders and allows them to offer more favorable terms. This can help entrepreneurs secure the funds they need to launch or expand their businesses, purchase inventory, or invest in equipment.

Crowdfunding

Crowdfunding platforms provide a unique opportunity for entrepreneurs to raise capital directly from a community of backers, often in exchange for rewards or equity in their business. Unlike traditional funding methods, crowdfunding allows you to showcase your business idea to a broader audience, tapping into the collective support of individuals who believe in your vision. This method not only helps generate funds but also enables you to build a supportive network of backers who can provide feedback, share your project, and even become loyal customers once your business is up and running. Popular platforms like Kickstarter and Indiegogo have successfully launched numerous startups, highlighting the potential of this funding approach.

Bootstrapping

Bootstrapping involves funding your business using your own resources, such as personal savings, revenue generated from early sales, or investments from friends and family. This approach empowers entrepreneurs to maintain control over their business decisions and avoid taking on debt, which can be especially important in the early stages when financial stability is uncertain. By relying on personal resources, business owners can gradually grow their operations at a manageable pace, allowing them to reinvest profits back into the company. While bootstrapping can be challenging, it fosters creativity and resourcefulness, encouraging entrepreneurs to find innovative solutions to problems without relying on external funding.

Tips for Using a Personal Loan Wisely for Your Business

If you decide to pursue a personal loan for business, keep these tips in mind to maximize the benefits and minimize the risks:

Budget Carefully

Creating a detailed budget is essential to ensure that you use the loan funds responsibly and allocate them to the most critical business expenses. Start by listing all potential costs associated with your business, including fixed and variable expenses. Careful planning not only helps you avoid overspending but also ensures that you don’t divert funds to non-business purposes, which can jeopardize your financial stability. Consider using budgeting software to track your expenses and adjust your budget as necessary, keeping your business goals in mind.

Prioritize Essential Expenses

When utilizing the personal loan, it’s important to focus on covering essential business costs that can significantly impact your operations and growth. This includes necessary expenses such as inventory, equipment purchases, or targeted marketing campaigns aimed at reaching your ideal customers. By prioritizing these essential costs, you not only make the most of the financing but also create a solid foundation for the growth and sustainability of your startup. Additionally, monitor the return on investment for each expense to ensure that your spending aligns with your business objectives.

Track Loan Repayments

Staying on top of your loan repayments is crucial for maintaining good financial health and avoiding late fees, which can add unnecessary costs to your loan. Additionally, late payments can potentially damage your personal credit score, making it harder to secure future financing. To keep your finances in check, set up a reliable system to monitor your repayment schedule. This could include setting reminders on your calendar or using financial management apps that alert you before a payment is due. Consistently making timely payments will help you maintain a healthy financial profile and improve your chances of obtaining favorable terms on future loans.

Frequently Asked Questions

Can I use a personal loan to start a business?

Yes, a personal loan for business purposes is permissible, but it’s essential to confirm with the lender if they allow it.

What are the risks of using a personal loan for business?

Risks include higher interest rates, personal liability for debt, and the potential to negatively impact your personal credit score.

How can I find the best personal loan for my business?

Compare loan terms from various lenders, including online lenders, and research their reputations to make an informed decision.

What are some alternatives to personal loans for business?

Consider small business loans, crowdfunding, and bootstrapping as alternative funding options to meet your financing needs.

Conclusion

Personal loans for business can be a viable funding option for startups, offering a more accessible and flexible alternative to traditional business loans. It’s crucial to carefully weigh the pros and cons, understand the qualification requirements, and explore alternative financing options before making a decision.

By researching your options, comparing lenders, and developing a solid plan for utilizing the loan funds responsibly, you can leverage a personal loan as a powerful tool in your entrepreneurial journey. To get started, explore reputable online lenders and compare their loan terms. Remember, choosing the right funding option is crucial for your startup’s success.