The average student loan debt in the United States has surpassed $37,000, making it a significant financial burden for many individuals. However, navigating the complexities of student loans can be challenging, particularly when it comes to understanding the fundamental question: is a student loan secured or unsecured? Student loans are classified as unsecured debt, meaning they are not backed by any specific asset. This classification can have significant implications for borrowers, including higher interest rates and limited options for debt relief.

Toc

- 1. Understanding the Distinction: Secured vs- Unsecured Loans

- 2. Is a Student Loan Secured or Unsecured?

- 3. The Implications of Unsecured Student Loans

- 4. Strategies for Managing Your Unsecured Student Loan Debt

- 5. Protecting Your Credit Score While Managing Unsecured Student Loans

- 6. Frequently Asked Questions

- 7. Conclusion

Understanding the Distinction: Secured vs- Unsecured Loans

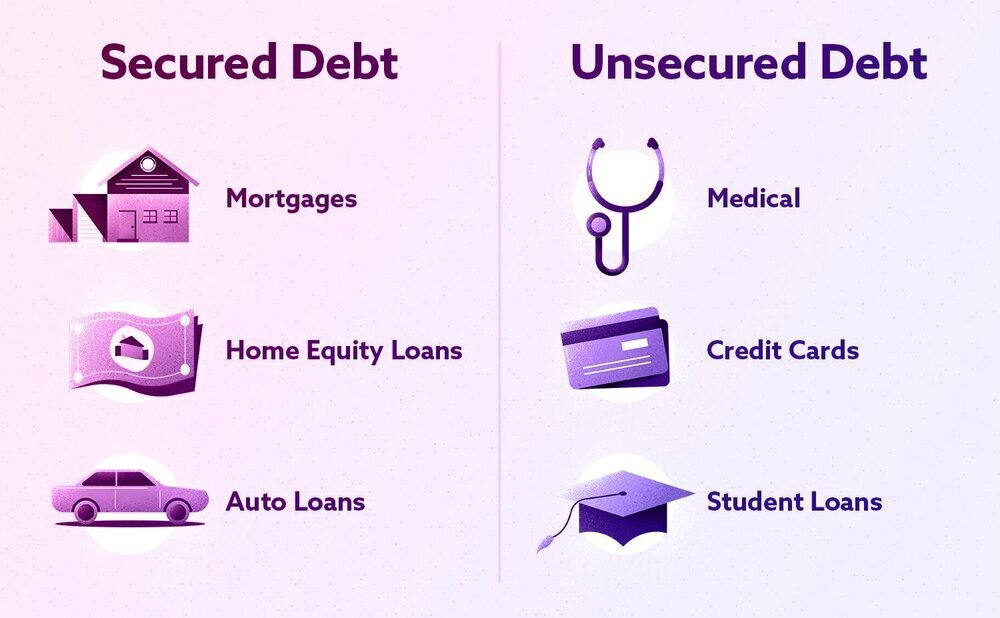

Secured loans are backed by collateral, meaning the borrower pledges an asset to the lender as a guarantee of repayment. If the borrower defaults on the loan, the lender can seize the collateral to recoup their losses. Common examples of secured loans include mortgages and auto loans, where the property or vehicle serves as the collateral.

On the other hand, unsecured loans are not backed by any collateral. Instead, lenders rely solely on the borrower’s creditworthiness and their promise to repay the debt. Examples of unsecured loans include credit cards, personal loans, and, as we’ll explore in-depth, student loans.

Key Characteristics of Secured Loans

- Collateral Requirement: Secured loans require borrowers to provide collateral, which can be seized by the lender in case of default. This collateral can take various forms, including real estate, vehicles, or other valuable assets.

- Lower Interest Rates: Because secured loans are less risky for lenders (due to the collateral), they often come with lower interest rates compared to unsecured loans. This can make them a more affordable option for borrowers.

- Risk of Losing Assets: Secured loans come with the risk of losing the collateral if the borrower defaults, creating a significant financial burden for those who fail to make timely payments.

Key Characteristics of Unsecured Loans

- No Collateral: Unsecured loans do not require any collateral. This means that lenders cannot claim any specific asset if the borrower defaults on the loan.

- Higher Interest Rates: Since unsecured loans are riskier for lenders, they typically come with higher interest rates. For instance, the average interest rate for a federal student loan in 2023 is around 5.3%, while private student loans can carry interest rates as high as 10% or more. This can leave students drowning in debt for years to come.

- Creditworthiness Assessment: Lenders assess the borrower’s creditworthiness based on their credit score, income, and financial history. A strong credit profile can lead to better loan terms, while a weak profile may result in higher interest rates or denial of the loan.

Is a Student Loan Secured or Unsecured?

Student loans are predominantly classified as unsecured debt because the educational experience they finance is considered an intangible asset. Unlike a mortgage or auto loan, where the lender can repossess the physical property, there is no collateral that a student loan lender can seize if the borrower defaults.

The Intangible Nature of Education

The education financed through student loans is an investment in human capital, but it is not a physical asset that can be repossessed. This intangible nature makes it challenging for lenders to secure their investment, leading to the classification of student loans as unsecured debt.

Lenders’ Risk Assessment

Instead, student loan lenders assess the risk of the loan based on the borrower’s future earning potential and creditworthiness. This makes student loans similar to other types of unsecured debt, such as credit cards and personal loans, where the lender’s primary recourse in case of default is to pursue legal action and damage the borrower’s credit score.

The Implications of Unsecured Student Loans

The unsecured nature of student loans can have significant financial implications for borrowers:

Higher Interest Rates

Because student loans are considered riskier for lenders, they often come with higher interest rates compared to secured loans like mortgages or auto loans. This can lead to a larger overall debt burden for students over the life of the loan. Federal student loans typically have fixed interest rates, while private loans may offer variable rates that can increase over time.

Credit Score Impact

Failing to make timely payments on an unsecured student loan can severely damage your credit score. A missed student loan payment can negatively impact your credit score for up to seven years, making it harder to qualify for future loans, credit cards, or even rental properties. This can make it more difficult to qualify for other types of credit in the future, and a poor credit score can lead to higher interest rates on any future borrowing, compounding the financial challenges faced by borrowers.

Difficulty Discharging in Bankruptcy

Unlike other types of unsecured debt, student loans are notoriously difficult to discharge through bankruptcy. This means that even if you declare bankruptcy, you may still be responsible for repaying your student loans. According to a 2022 study by the National Student Loan Data System, less than 1% of student loan borrowers successfully discharged their debt through bankruptcy. The legal standards for discharging student loans in bankruptcy are stringent, requiring borrowers to demonstrate undue hardship, which is often challenging to prove.

Strategies for Managing Your Unsecured Student Loan Debt

Regardless of whether your student loans are secured or unsecured, it’s essential to develop a strategic approach to managing your debt. Here are some tips to consider:

Create a Budget and Prioritize Payments

Prioritize your student loan payments by creating a realistic budget that accounts for your monthly expenses and income. This will help you ensure that you’re making on-time payments and avoiding late fees or penalties. A well-structured budget can also help you identify areas where you can cut back on spending to allocate more funds toward your loan payments.

Explore Repayment Options

Federal student loans offer a variety of repayment plans, including income-driven options that can adjust your monthly payments based on your income. The rise of income-driven repayment plans (IDRs) has made student loan repayment more manageable for many borrowers, especially those with lower incomes. IDRs can help borrowers avoid default and keep their credit scores healthy by adjusting monthly payments based on income levels. Private lenders may have less flexibility, but it’s worth discussing your options with them. Some lenders may offer deferment or forbearance options in times of financial hardship.

Consider Consolidation or Refinancing

Consolidating or refinancing your student loans can potentially lower your interest rate and simplify your repayment process. Consolidation allows you to combine multiple federal loans into a single loan with a fixed interest rate, while refinancing can help you secure a lower rate based on your current creditworthiness. However, it’s important to carefully evaluate the terms of any consolidation or refinancing agreement, as it may affect your eligibility for certain repayment plans or loan forgiveness programs.

Make Extra Payments

Whenever possible, make additional payments on your student loans to help reduce the principal balance and pay off the debt faster. Even small extra payments can make a significant difference over time. Consider making extra payments when you receive bonuses, tax refunds, or other unexpected income. This strategy can help reduce the overall interest you pay and shorten the repayment period.

Explore Loan Forgiveness Programs

If you work in certain public service or nonprofit roles, you may be eligible for student loan forgiveness programs that can cancel a portion of your debt after meeting specific requirements. Programs like Public Service Loan Forgiveness (PSLF) can provide significant relief for qualifying borrowers. Be sure to stay informed about the eligibility criteria and application processes for these programs.

Protecting Your Credit Score While Managing Unsecured Student Loans

As an unsecured debt, your student loans can have a significant impact on your credit score. To maintain a healthy credit profile, be sure to:

Make all of your student loan payments on time

Making timely payments is crucial for maintaining a positive credit score. Set up automatic payments or use calendar reminders to ensure you never miss a due date. Additionally, consider enrolling in autopay programs offered by many lenders, which may also reduce your interest rate slightly as an incentive.

Monitor Your Credit Report

Regularly check your credit report to stay aware of your credit status and to identify any discrepancies or errors. You are entitled to one free credit report annually from each of the three major credit bureaus (Equifax, Experian, and TransUnion). Reviewing your report can help you catch issues like reporting errors, which can be disputed and corrected.

Avoid Other Unnecessary Debts

While managing your student loans, try to avoid accumulating other forms of high-interest debt, such as credit card balances. Focus on reducing your student loan balance before taking on additional financial obligations. This strategy will help you maintain a healthier debt-to-income ratio and make it easier to manage your finances overall.

Use Credit Responsibly

Maintaining a mix of credit accounts, such as a credit card or small personal loan, can be beneficial if managed responsibly. Keep your credit card balances low relative to your credit limit and always make payments on time. This demonstrates responsible credit behavior and can positively impact your credit score.

Seek Professional Financial Advice

If you’re struggling to manage your unsecured student loan debt, consider consulting a financial advisor. These professionals can provide personalized guidance and help you develop a comprehensive debt management plan tailored to your unique financial situation. They can also offer strategies for budgeting, saving, and improving your overall financial health.

By following these strategies, you can effectively manage your unsecured student loan debt while protecting and even improving your credit score. Taking proactive steps toward financial responsibility will help secure a more stable economic future and reduce the stress associated with debt repayment.

Frequently Asked Questions

Q: Can I convert my student loan to a secured loan?

A: No, it is not typically possible to convert a student loan to a secured loan. The nature of student loans makes them inherently unsecured due to the intangible nature of education.

Q: What happens if I default on my unsecured student loan?

A: Defaulting on your student loan can have severe consequences, including damage to your credit score, wage garnishment, and potential legal action. Additionally, your loan balance may increase due to late fees and penalties.

Q: Are there any benefits to having an unsecured student loan?

A: Unsecured student loans offer flexibility in repayment options, and you don’t risk losing any collateral. While unsecured student loans may have higher interest rates, they often offer more flexible repayment options and may be more accessible to borrowers with less-than-perfect credit histories.

Q: How can I improve my chances of qualifying for loan forgiveness?

A: To improve your chances of qualifying for loan forgiveness programs, ensure that you are enrolled in an eligible repayment plan and that you are working in a qualifying public service or nonprofit role. Keep thorough records of your employment and payments to facilitate the application process. Additionally, aim to make all of your payments on time and stay informed about any program updates or changes.

Q: Is bankruptcy an option for managing unsecured student loans?

A: In most cases, it is challenging to discharge student loan debt through bankruptcy. You would need to prove that repaying the loans would cause undue financial hardship, which can be difficult to demonstrate. It’s best to explore other options for managing your loans before considering bankruptcy. Overall, being proactive in managing your unsecured student loans is the most effective strategy for avoiding default and reducing the overall burden of debt. Consider using these tips and seeking professional guidance as needed to develop a comprehensive plan for successfully managing your loans. Your future self will thank you for taking control of your financial health and securing a brighter financial future. So, don’t hesitate to take action and stay informed about any updates or changes in loan forgiveness programs or other options that may benefit you as a borrower.

Conclusion

In conclusion, understanding the distinction between secured and unsecured loans is crucial when it comes to managing your student debt. The question is a student loan secured or unsecured? is answered with the understanding that student loans are classified as unsecured debt, which means they are not backed by any physical collateral. This can have significant implications for borrowers, including higher interest rates, potential credit score damage, and difficulty discharging the debt in bankruptcy.

By developing a strategic approach to managing your unsecured student loan debt, you can navigate the complexities of the student loan landscape and set yourself up for long-term financial success. Remember, staying informed and proactive in your student loan management can go a long way in achieving your financial goals. With careful planning and effective strategies, you can mitigate the risks associated with unsecured student loans and work towards a more secure financial future.